If, over the space of a few days, weeks, or even months, your investment portfolio dived by 40% what would be your reaction?

I guess, for a lot of people it would be along the lines, that they needed to stem the flow of losses. Cash, never seems to make a negative return, so why not sell down the investment portfolio and put it all into cash? Seems like a decent option at the time.

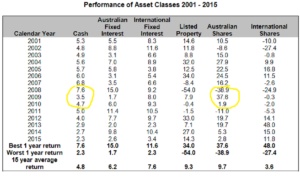

At the time the GFC hit in 2008, the Australian share market (ASX 300) was down 39% for the calendar year. Over this time investing in Cash would have yielded you a 7.60% return. Seems like a worthy option to switch from an investment returning negative 39% to one that returned positive 7.60% – “a no-brainer” really…. Or really?

You see, the trouble with trying to chase returns (switching from a poorly performing investment to a better performing) is that you still cannot guarantee that the investment you switched to will continue to perform strongly into the future.

Following the above example, the person who switched to Cash would have yielded a 3.5% return the following year (2009). I guess these people would be happy with their actions, thinking they not only stemmed the tide of negative returns, but then managed to create a nice little positive return the next year (2009). But what about if these people had just done nothing… maybe burying your head in the sand, or being in denial about your portfolios dismal performance is a better course of action?

If someone had of left their investment portfolio (Assume ASX 300) and did absolutely nothing in 2008, then the following year they would have made a positive 37.60% return in 2009. That’s right, 37.60% for doing absolutely nothing!

Interestingly, if we continue with the same level of thought for 2009 – people in cash (3.50% return) should switch to shares because the ASX returned 37.60% (chasing returns) that year. As a result of this it would mean in 2010 your return on ASX/shares would have returned just 1.90% whilst cash returned 4.70%. See what I’m getting at here?

History in investment markets, shows the same results all over the world. Take a look a Vanguard, one of the worlds largest Fund Managers and the study they did into this type of stuff. It’s the same story.

Buy-and-Hold versus Performance-Chasing: Large Cap (Source: Vanguard)

Now, when the GFC hit the low point was in 2009 – and we can see the result below if we started with $50,000 before the crash. Doesn’t look good does it? This is where people think to switch to cash.

Now take a look afterwards – We go above and beyond, not only recouping losses but making nice positive returns. All from holding steady and not switching asset class.

This graph shows the month-end balances of a hypothetical $50,000 investment in the Standard & Poor’s 500 Index between August 2007 and October 2015. Assumes reinvestment of earnings.

Source – https://investor.vanguard.com/investing/portfolio-management

Now for most people we already have our own investment funds – our Super funds. I have heard numerous people tell me, that they switched their investment from either a growth or balanced portfolio to cash, during the GFC. They always seem to tell me with a swagger or confidence that implied they were on top of the situation, however many done made the change due to fear. Truth be told, these people likely didn’t make the best decision, and were probably swayed by a combination of Media hype, “doom and gloom” and a herd mentality, meaning “if everyone else is doing it, then I better do it.”

The reality for most of these people is that they still had 10, 20, 30+ years until retirement. When the 1987 stock market crashed did everyone think it was the end of the world? Yep! Was it the end of the world? Nope. Same goes for the GFC in ‘07, Asia Crisis of’97, and Dotcom Bubble of 2000. History and investment markets are littered with events that have impacted investment returns. History should also show that Markets seem to always recover and go above and beyond their previous levels. After all it’s not like the world stops, and we descend back into the dark ages.

In conclusion, you should keep in mind your investment horizon, understand the cyclical nature of investment markets and don’t be swayed by everything you hear in the news, or what everyone else is doing. Have your plan, and have conviction to stick to it… even if it involves doing nothing!