What does your retirement look like for you? Cruising up the coast, checking out the sights on a long trip to Broome, playing more golf, fishing, more gardening, time with the Grandchildren…. All nice, and plausible things to do in retirement.

For some people Retirement doesn’t look anything like this. Why?

- They can’t afford to have the lifestyle they want.

- They like getting up in the morning and going to their job and don’t want to retire.

- They aren’t old enough for the Age Pension

Those who can’t afford to retire are generally forced to keep working as long as they can to build their wealth to a desirable level in order to maintain a lifestyle they envisage in retirement.

Those who just want to keep working full-time are fairly rare, but there are a lot of people who would actually prefer to work reduced hours (part-time), for various reasons. Maybe it’s the fact that sometimes early retirement can be the kiss of death for a lot of people, or it still keeps them active. There are a multitude of reasons, but nonetheless there are a great deal of people who are in this situation.

For those who are old enough to retire (say age 60) but don’t qualify for the Age Pension (Age 65-67 depending the year you are born) it might be a case they would rather keep working until they meet that criteria, so as not to draw down on their Superannuation. Obviously they may not be able to afford to retire anyway (reason one from above).

How do a lot of people successfully transition into retirement?

In the Financial Planning world, an ideal strategy is one appropriately called a Transition to Retirement Strategy (TTR).

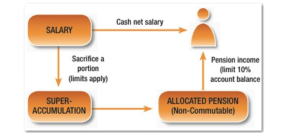

A Transition to Retirement (TTR) strategy can be a very powerful way to increase your super balance as you near retirement, without reducing your after-tax income. Effectively, you transfer your Super over into Pension phase and draw an income from the Pension (tax free if over 60).

TTR in practice

There are two main ways you can use a TTR strategy

- Less work, same income

As you are receiving more income from the Pension, you could cut down your working hours while maintaining the same level of income, as your take-home pay will be the same.

- Same hours, more super

The other option is to maintain your work hours, but increase your salary sacrifice contributions to super, and supplement your income with a TTR pension. Eg. Rather than your income being taxed at your marginal rates (eg 34.5%, 39% etc) the money salary sacrificed into super only incurs 15% tax, which is called contributions tax. What is happening here is that you are creating a tax effective way of earning an income.

The above is a brief explanation of a TTR strategy as there are a number of factors to take into account with it, but it is one very useful strategy to either

Boost your retirement savings so that you can achieve the lifestyle you want in retirement.

Allow you to reduce your working hours, and maintain your income if you did not want to completely retire.

It is important to get advice with this strategy to make sure it is viable, and to adhere to Superannuation rules. In Particular advice is needed if you have a GESB fund as they sometime have slightly different rules to adhere to.

If you would like more information please contact me.